It’s also not unusual after they have evidence via courtroom papers or another papers like official document words you are indeed the right particular person and how the personal loan was validly obtained, to enable them to proceed to close up your original situation since there’s no reason for suing you given that they can’t get other things out from you at this stage (and in all likelihood made the decision earlier on not to sue just according to anything they saw when analyzing your case).

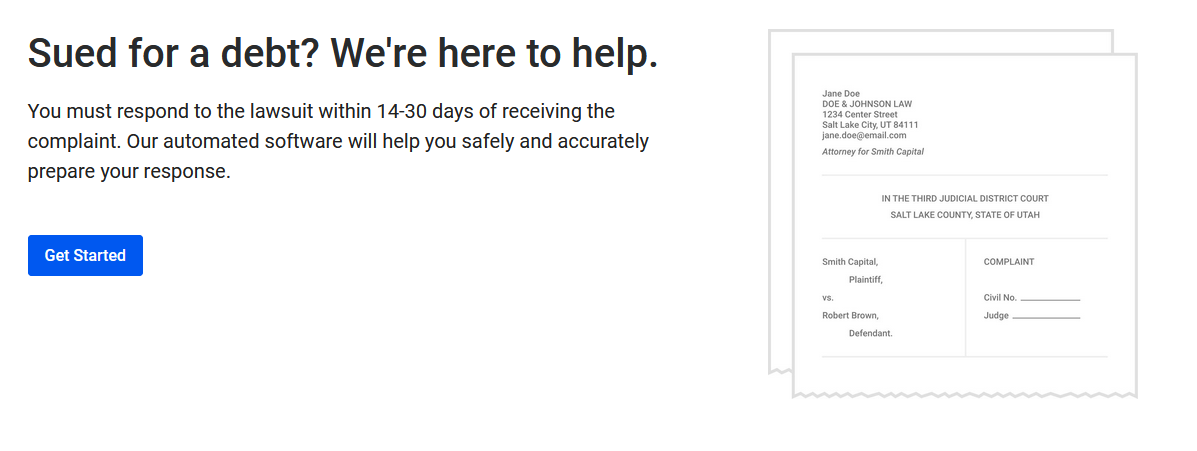

If, nevertheless, they reopened it, then sure, go ahead and, you need to send the proof—that’s your proper in any case. Have a look at how to respond to a lawsuit!

So now let me clarify why it’s not unusual for loan companies to take this strategy:

If they didn’t file anything so you have been meant to pay, then you certainly was unsuccessful to do so. And if that’s correct, then clearly there is nothing at all preventing them from suing you, which suggests within their eye (and totally reasonable) they did everything in their potential before taking this path (i.e., don’t sue me due to the fact I’m striving anything else initially).

Whether they really are undertaking almost everything under the sun about collections is irrelevant—if they’re declaring they do. Continue to, you may have evidence demonstrating otherwise (including records exhibiting efforts at contact), then indeed, needless to say, provide that information (see below).

Credit history reviews

I believe that this because not being provided and your account getting past the statute of limits are two typical reasons why profiles show up on credit reports as “judgement making protected” without being paid off or determined with the creditor.

It’s also an additional example of why it pays to pull your personal reviews from organizations like TransUnion and Equifax in order to see what they’re reporting—if it doesn’t appear sensible, then dispute it together right away.

So permit me to supply you with a number of instances of why this could take place now:

When the creditor shut your account because of non-transaction and after that later made a decision to reopen it, they are able to sue you for violating the regards to your original agreement—but there’s really no hurt in suing since you already neglected to spend as originally arranged.